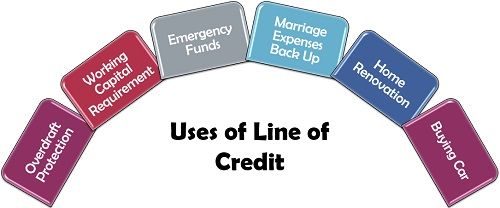

For example, many loan agreements require the borrower to (i) make a solvency representation (ii) represent that there is no material litigation (iii) make a representation as to compliance with its material contracts and (iv) otherwise represent that there is no existing default or event of default. The MAE representation is usually not the only representation that needs to be satisfied as a condition to each revolver drawing. That said, notwithstanding the extended duration of the COVID-19 pandemic, it remains the case that lenders rarely, if ever, invoke the MAE clause as a basis to deny a draw on an existing revolver. Prior to making any certification there has been no MAE, a borrower should carefully review the MAE clause under its loan agreement and consider whether the COVID-19 pandemic has resulted in an MAE that would affect the borrower’s ability to make this certification and otherwise limit, or even preclude, the borrower’s ability to draw on its revolver. Thus, depending on how the MAE clause is drafted, a draw down could be challenged if the borrower’s business has been materially and immediately impacted by the pandemic specifically or that economic uncertainty resulting from the pandemic generally will likely create a material inability of borrower to perform its obligations under the loan agreement. Similarly, an MAE clause may be limited to a material deterioration in the borrower’s ability to meet its obligations under the loan agreement, but adverse effects on the borrower and its business generally would not constitute the occurrence of an MAE. Other MAE clauses, by contrast, may be limited in scope, for instance applying only to the immediate, foreseeable effects of an event. For example, an MAE clause under one loan agreement may be broad, encompassing adverse effects on the borrower and its business generally or including future consequences of an event such as a failure to satisfy future financial covenant tests. Borrowers would be well served to review the specific MAE definition under their particular loan agreement in connection with any draw down request. MAE provisions are often heavily negotiated and vary from deal to deal. An MAE is generally defined to include events or circumstances having a material adverse effect on the business, operations, condition (and sometimes even future ’prospects’) of a borrower and its ability to meet its obligations under the loan agreement. Under most loan agreements, as a condition to borrowing a borrower must certify in writing that no MAE has occurred. Borrowers should nonetheless be aware of some important issues and considerations prior to drawing down a revolver.Ī gating issue for any borrower seeking to draw down on an existing line of credit is whether the borrower can meet the loan agreement’s borrowing requirements, in particular the “material adverse change” or “material adverse effect” (MAE) representation. Similarly, companies with sufficient cash for the near term are nonetheless considering drawing down on their revolvers as a precautionary measure to ensure they have enough cash on hand to meet obligations and outlast the COVID-19 crisis.ĭrawing down a revolver may indeed be one of the best ways for borrowers to meet current obligations and preserve their cash position as they ride out the adverse economic impact of the pandemic. As a result of this cash crunch, many companies with access to existing credit lines are considering whether to draw down on the unused availability to meet their current obligations.

Meanwhile, the on-going obligations that companies incur in the ordinary course of business continue to accrue and remain due and payable. In this post, we examine one of these key issues in greater detail, namely drawing down on existing lines of credit, or ’revolvers’.Īs a result of the pandemic, many businesses are experiencing wide-spread revenue shortfall, and in some instances cash flow has ceased entirely. In a recent post, we examined the pandemic’s effect on corporate loan agreements and identified some key issues that borrowers should consider.

Drawing Down on Existing Lines of Credit.

0 kommentar(er)

0 kommentar(er)